When one of my clients launched their first SaaS content strategy back in 2002, the landscape was dramatically different. The industry was still figuring out what “software as a service” even meant—let alone how to market it effectively. Fast forward to today, and they’ve helped dozens of SaaS companies develop content strategies that enabled them to compete against industry giants with 100x their marketing budget.

The secret? SaaS competitive content analysis isn’t just a nice-to-have—it’s the foundation of any successful content marketing program in the hyper-competitive software space.

The David vs. Goliath Reality of SaaS Marketing

Let’s be honest—as a smaller or mid-market SaaS provider, you’re not playing on a level field. Enterprise competitors have deeper pockets, larger teams, and often longer-established domain authority.

But here’s what they’ve learned after two decades in the trenches: being nimble gives you advantages the big players can’t match. They’ve watched scrappy SaaS startups outmaneuver enterprise competitors by being more focused, more specialized, and frankly, more strategic about their content.

Take Pipedrive, for example. When they entered the CRM space in 2010, they were facing off against Salesforce, Microsoft, and other behemoths. Today, they’ve carved out a significant market share by focusing intensely on sales-process content that directly addressed pain points Salesforce was overlooking.

Why Traditional Competitor Analysis Falls Short for SaaS

Many SaaS marketers they consult with initially approach competitive analysis all wrong. These marketers obsess over feature comparisons and pricing models while missing the real opportunity: content that shapes the buying journey.

According to research from Gartner, B2B buyers spend only 17% of their purchase journey meeting with potential suppliers. The rest of their time? They’re consuming content, comparing options independently, and forming opinions long before they ever reach out.

This is why SaaS content strategy must be built on thorough competitive content analysis—not just product comparisons.

The 5-Step SaaS Competitive Content Analysis Framework

After refining this approach through hundreds of client engagements, they’ve developed a framework specifically for SaaS companies looking to outrank enterprise competitors. This isn’t theoretical—it’s battle-tested and practical.

Step 1: Map the Competitive Content Landscape

Before creating content, you need to understand what you’re up against. This goes beyond basic keyword research.

Start by identifying your top 3-5 competitors (including 1-2 aspirational competitors above your weight class). For each, catalog:

- Content types: What formats do they prioritize? (blogs, whitepapers, webinars, etc.)

- Content themes: What topics do they cover most comprehensively?

- Content gaps: What relevant topics are they notably NOT addressing?

- Content performance: Which of their pieces perform best? (Use tools like Ahrefs or Semrush)

The goal is to create a “content competitor matrix” that reveals patterns and opportunities.

When they performed this analysis for a mid-sized CPQ (Configure, Price, Quote) software provider, they discovered that while the industry leaders had comprehensive product-focused content, they were completely neglecting content around implementation challenges—a major pain point for their users. This single insight led to a content hub that now drives 35% of their qualified leads.

Step 2: Conduct a Deep Content Gap Analysis for SaaS

Content gap analysis identifies topics your competitors rank for that you don’t. But effective content gap analysis for SaaS requires going deeper than standard SEO tools suggest.

They recommend this three-pronged approach:

Keyword Gap Analysis: Use tools like Ahrefs’ Content Gap feature to identify keywords your competitors rank for that you don’t. Filter for keywords with:

- High business relevance

- Moderate-to-high search volume

- Lower keyword difficulty (under 50)

Topic Cluster Analysis: Look beyond individual keywords to identify entire topic clusters your competitors own. For each major competitor, identify:

- Their 2-3 strongest topic clusters

- The supporting content pieces within each cluster

- The internal linking structure supporting those clusters

User Journey Analysis: Map your buyer journey stages and analyze competitor content against each stage:

- Awareness stage content

- Consideration stage content

- Decision stage content

This approach helped one of their clients, a document automation SaaS, discover that while they were competing effectively for decision-stage keywords, they were virtually invisible for awareness-stage topics. By creating comprehensive guides addressing early-stage pain points, they increased organic traffic by 218% within 6 months.

Step 3: Quality Assessment: Finding the Advantage

To outrank enterprise competitors, you need to understand not just where their content exists, but how good it actually is. This is where most SaaS companies miss opportunities.

For each key content piece from competitors, evaluate:

- Content Depth: Does it thoroughly answer the user’s question? Or is it superficial?

- Content Freshness: When was it last updated? Is it still accurate?

- Content Format: Is it presented optimally for the user intent?

- Content Credibility: Does it include original research, expert quotes, or unique insights?

- Content Experience: Is it well-designed, engaging, and easy to navigate?

They’ve found that enterprise SaaS companies often sacrifice quality for quantity. Their content is frequently:

- Written by generalist copywriters without deep subject expertise

- Outdated (often 12+ months since last update)

- Lacking practical, actionable insights

- Missing technical depth that practitioners need

This quality assessment often reveals your biggest competitive opportunity. When they performed this analysis for a product analytics SaaS company, they discovered their largest competitor’s content was comprehensive but extremely technical and difficult to understand. They created alternative resources that explained the same concepts using simple language and practical examples—which now rank above the competitor for 28 high-value keywords.

Step 4: Develop a Differentiated Content Strategy

Armed with your competitive content analysis, you can now build a SaaS content strategy that exploits gaps and leverages your unique advantages.

Your strategy should include:

Content Positioning Statement: A clear articulation of how your content will be different and better than competitors. For example: “While Competitor X creates comprehensive but technical guides, our content will make the same topics accessible to non-technical product managers with practical, implementation-focused advice.”

Priority Topic Clusters: Based on your gap analysis, identify 3-5 topic clusters where you have the greatest opportunity to compete and win.

Content Differentiation Tactics: For each priority topic, define specific approaches to make your content superior:

- Original research or data

- Unique expert perspectives

- Superior visual explanations

- More comprehensive coverage

- More current information

- Better practical applicability

Content Format Strategy: Identify formats that competitors underutilize but align with your audience preferences.

When they implemented this approach for a cloud security SaaS provider, they found their enterprise competitors were producing extensive technical documentation but very little content explaining regulatory compliance implications—a major concern for their target audience. By creating a dedicated compliance content hub with practical templates and checklists, they established authority in this niche and began outranking much larger competitors.

Step 5: Execution and Iteration: The Competitive Advantage

The final step is where most competitive SEO for SaaS efforts succeed or fail: consistent execution and data-driven iteration.

Create a content calendar based on your strategy, but with these critical components:

- Performance Benchmarking: For each piece, identify the specific competitor content you aim to outperform and the metrics that will define success.

- Publication Schedule: Commit to a sustainable publishing cadence that prioritizes quality over quantity.

- Update Protocol: Establish a systematic process for regularly updating existing content based on performance data and competitive movements.

- Amplification Plan: Define how you’ll promote each piece to accelerate its impact and indexing.

- Measurement Framework: Set up analytics to track not just traffic, but engagement, conversions, and ultimately, content ROI.

The most successful SaaS content programs they’ve managed share one common trait: they treat content as products that continuously improve through iteration. When a financial operations SaaS they worked with launched a resource center targeting enterprise CFOs, they didn’t just publish and move on—they analyzed user behavior, gathered feedback, and made improvements every two weeks. Within 9 months, their resource center was driving more qualified enterprise leads than all other marketing channels combined.

Visualizing Your Competitive Content Position

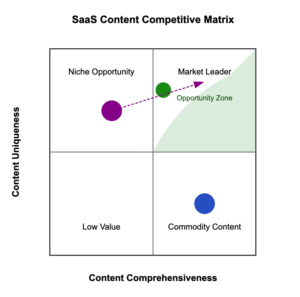

To help their clients understand their competitive content position, they’ve developed the SaaS Content Competitive Matrix:

This visualization maps content assets across two dimensions:

- Content Comprehensiveness (depth and breadth of coverage)

- Content Uniqueness (originality of insights and approach)

By plotting both your content and competitor content on this matrix, you can identify strategic opportunities to differentiate.

Case Study: How ContentStack Outranked Adobe with Strategic Content

One of their favorite success stories comes from working with ContentStack, a headless CMS provider competing against industry giant Adobe. When they began their engagement, ContentStack was virtually invisible for high-value search terms.

Through comprehensive SaaS competitive content analysis, they discovered Adobe’s content excelled at explaining the “what” of headless CMS technology but neglected the practical “how” that developers and marketers needed.

Their strategy focused on creating deeply practical implementation guides, migration tutorials, and integration walkthroughs—precisely the content Adobe wasn’t providing.

The results speak for themselves:

- 215% increase in organic traffic within 12 months

- First-page rankings for 76 high-value keywords previously dominated by Adobe

- 43% increase in qualified leads from organic search

Most importantly, this content strategy helped position ContentStack as the more developer-friendly alternative to Adobe, influencing not just their SEO performance but their overall market perception.

Common Pitfalls in SaaS Competitive Content Analysis

Through their work with dozens of SaaS companies, they’ve observed several common mistakes:

Obsessing Over Volume: Many companies prioritize topics with high search volume rather than high relevance to their unique value proposition.

Copying Competitor Approaches: Simply creating “me too” content rarely results in better rankings or conversions.

Neglecting Audience Specificity: Enterprise competitors often target broad audiences; your advantage lies in speaking more directly to specific user personas.

Prioritizing New Content Over Updates: Often, updating existing content delivers faster results than creating new pieces from scratch.

Missing Technical SEO Foundation: Great content won’t rank without solid technical SEO fundamentals in place.

Looking Forward: The Evolving SaaS Content Battlefield

As we look ahead, several trends are reshaping competitive SEO for SaaS:

AI-Generated Content: As AI content generation becomes mainstream, quality differentiation will come from unique subject matter expertise and original insights that AI can’t provide.

Search Intent Refinement: Search engines are increasingly sophisticated at understanding user intent, rewarding content that best addresses the specific needs behind a search query.

User Experience Factors: Content experience metrics like page speed, readability, and engagement are gaining more weight in ranking algorithms.

Brand Authority Signals: Google’s E-E-A-T guidelines emphasize expertise and authority, making thought leadership content increasingly valuable.

Conclusion: Your Path Forward

After 20+ years in this industry, they’ve learned that SaaS competitive content analysis isn’t a one-time exercise—it’s an ongoing practice that should inform your entire marketing approach.

Remember these key principles:

- Your greatest content opportunities often lie where competitor content exists but underserves the audience.

- Technical depth combined with accessibility is a powerful differentiator in SaaS content.

- Consistent execution and iteration ultimately win over sporadic brilliance.

- Your unique perspective and expertise are competitive advantages the giants can’t easily replicate.

The SaaS companies that consistently outrank larger competitors aren’t necessarily those with the biggest budgets or the most content—they’re the ones that most deeply understand competitive content gaps and fill them with exceptional resources.

About the Author: Uddeshya has advised content strategy for over 75 SaaS companies, from early-stage startups to enterprise platforms. He specialize in helping technical SaaS products translate complex capabilities into clear, compelling content that drives organic growth.